Table of Contents

- Consumer Price Index For January 2024 - Rahel Latashia

- All India Consumer Price Index For March 2024 - Jammie Chantalle

- Must-watch consumer trends for 2024 | Statista

- Consumer Price Index 2024 Philippines Today - Doro Nanete

- Floral Trend Report 2024 - part 2 | Marginpar

- Consumer-Trends-2024-Mid-Year-Chart.052 - The New Consumer

- Self-Storage Almanac 2024 :: Preview Issue

- Prediction of Indonesian Consumer Behavior 2024

- Base year for CPI may be changed to 2024 - Economy News | The Financial ...

- Experts on the Record: What's Ahead for Consumers in 2024 - IFT.org

Understanding CPI and Inflation

2024 CPI and Inflation Projections

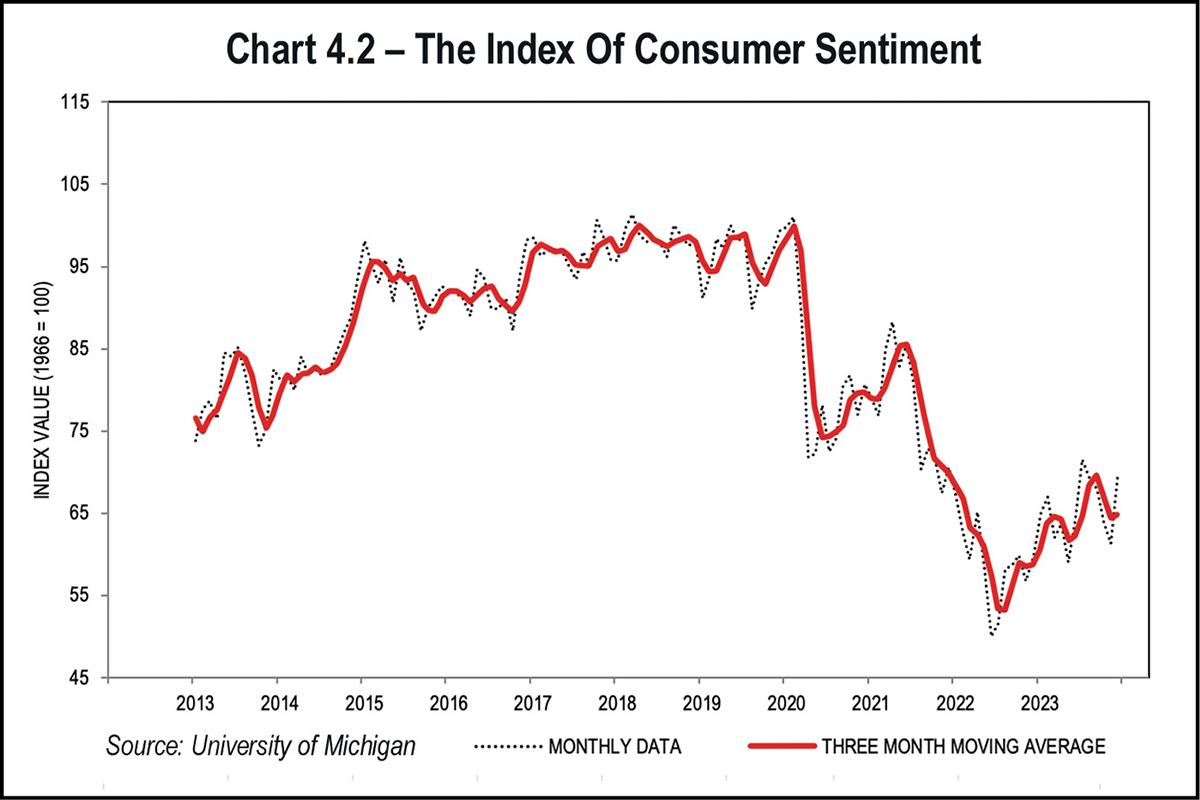

The core CPI, which excludes volatile food and energy prices, is expected to show a steady increase, reflecting the underlying inflation trend. This is crucial for the Federal Reserve as it considers interest rate adjustments to balance economic growth with price stability. For consumers, a moderate inflation rate can mean a gradual increase in the cost of living, but it also suggests a growing economy with potential for wage increases and job market stability.

Impact on the US Economy and Consumers

The implications of the 2024 CPI and inflation data are multifaceted. For investors, a stable inflation rate can lead to more predictable market conditions, potentially boosting confidence in the stock market and other investments. However, for consumers, even a moderate increase in prices can affect budgeting and savings, especially for essential goods and services.Furthermore, the inflation rate influences interest rates, which can impact borrowing costs for mortgages, car loans, and credit cards. A well-managed inflation rate is essential for maintaining economic balance, supporting both growth and stability. Policymakers will closely monitor CPI and inflation trends to make informed decisions about monetary policy, aiming to nurture a favorable economic environment.

The 2024 CPI and inflation data for the United States offer valuable insights into the nation's economic trajectory. As the year unfolds, these indicators will continue to guide economic policy, influence market trends, and impact the daily lives of Americans. Whether you're an investor looking to make informed decisions or a consumer trying to navigate the cost of living, understanding CPI and inflation trends is more important than ever. By staying abreast of these economic indicators, individuals and businesses can better prepare for the future, leveraging opportunities and mitigating challenges in an ever-evolving economic landscape.For the most current and detailed information, it's advisable to consult the official Bureau of Labor Statistics website or other reputable economic resources. Staying informed will empower you to make wise financial decisions and contribute to a resilient and thriving US economy.